Learning to trade commodities is a great way to profit from markets, as they are highly liquid, and can add another way to diversify your portfolio. This is especially true in an inflationary environment, which tends to be very good for these assets.

What are commodities?

The term “commodity” is an umbrella term that refers to “things that people use.” A commodity is a raw material that consumers or producers use. There are a whole host of assets that are traded in this arena of financial assets, such as gold, oil, and wheat.

A commodity is a raw material that consumers or producers use.

The commodity markets have been used for years to lock in prices by producers, as well as a hedge. For example, a company like Kellogg’s buys corn contracts to know exactly what price the company will pay for that commodity at a specific time.

However, the average trader is simply speculating on the price of these assets. By following supply and demand, as well as trends, traders have found these markets to be very worthwhile.

Some major commodities include:

- Energy: Oil and Natural Gas

- Agricultural: Wheat, Corn, and Cotton.

- Minerals: Gold, Silver, and Copper

There are other markets, but these are some of the biggest.

A History of Commodities Trading

Commodity trading is believed to have been taking place since 4500 BC in Sumer. Samarians used clay tokens to represent the number of goats or other agricultural goods to be delivered. The required delivery date was structurally similar to a modern-day futures contract.

In the late 10th century, commodity markets started to pop up across Europe. These started to look more like the markets that you would recognize now, as they started to use standardized contracts of specific commodities in places like Haarlem or Amsterdam. The Amsterdam Stock Exchange originated as a commodities market.

The United States started using standard instruments at the Chicago Board of Trade in 1864. Originally just wheat, corn, cattle, and pigs, more commodities were added in the 1930s and 1940s. Initially used to hedge market risks by farmers and corporations, these futures markets are now just as likely to be used for speculation.

What Is Commodity Trading?

Commodity trading is the exchange of money for raw materials or vice versa. While there are a host of other traders in the markets, most commodity traders are speculative in nature. The trader will either buy or sell a contract to take advantage of price movement, much like any other market.

Commodity trading is the exchange of money for raw materials or vice versa.

The commodities markets are much more straightforward than some other markets. The laws of supply and demand are much more widespread in this type of instrument, and therefore a lot of traders are attracted to the commodity markets. As a commodity trader, you don’t typically have to worry about as much as you do in other markets when doing your research. Either there is enough supply to cover demand or not.

Why You Should Trade Commodities

The main reason you should trade commodities is that they are one of the purest forms of trading available. If there is more demand for raw materials due to a shortage, the price will go higher. You do not need to worry about external factors as much as you do in other markets either. Commodities can also be used as a proxy for economic growth, especially in the case of energy.

- Pure price action: Commodities have much less in the way of interference when it comes to price. Either something is in demand, or it is not.

- CFD markets: By using CFD markets, you can trade in reasonable sizes, no matter the size of your trading account.

- Open almost all hours: Except the “settlement hour”, commodities trade nearly around-the-clock, offering people from all over the world to speculate.

- Diversification: One of the best ways to protect your wealth is to diversify. Trading in commodities can achieve this in ways that stocks or currency cannot.

What Are the Risks of Trading Commodities?

SmartCryptex goes out of its way to mitigate most of the risks involved in trading from an operational or structural standpoint. There is always a certain amount of risk when trading anything, but most of the concerns that traders will face are handled discreetly behind the scenes by our staff.

- Operational Risks: Operational risks can be anything from computer systems to accounting issues at a company. There have been commodity brokers in the past that have had issues, but as regulation tightens and liquidity increases, this is becoming much less common.

- Counterparty Risks: Counterparty risks include when a trade contract is made between two entities in a market. However, the careful selection of liquidity providers by SmartCryptex ensures that your order will always be matched.

- Credit Risks: Credit risks revolve around one party not paying the other, which is completely mitigated by using a liquidity provider to match orders. This is generally something that large institutions face.

- Liquidity Risks: Liquidity concerns are a major problem with markets, as volume is not always large enough to facilitate efficient markets. However, SmartCryptex only offers the most liquid commodities.

- Compliance Risks: When trading markets, compliance with regulation is crucial. The liquidity providers that we use at SmartCryptex are some of the largest and most regulated in the world.

- Market Risks: Market movement can cause a significant amount of risk when volatility picks up. This will be the same in commodity markets as it is in any other one.

- IT Risks: There is always the risk of something going wrong with a computer or a system when trading electronically. Commodity markets are digital markets, so this must be mentioned. However, SmartCryptex has world-class technology to mitigate risks.

How to trade commodities

Learning how to trade commodities is your first step to profiting. The trader will have to understand some of the unique characteristics of the markets, as well as build a profitable system. With a bit of research, you will learn to trade commodities just like any other market.

Choose what commodity you want to trade

When you trade commodities, you have a whole host of potential raw materials that you can be speculating on. Some traders will stick to one particular commodity, while others will trade multiple markets. Because of this, traders build a system to take advantage of opportunities, sometimes being specifically built for a particular market, sometimes the trader will use a particular type of system for everything.

Hard commodities

Hard commodities are best thought of as raw materials that are mined or extracted from the ground. This includes gold, oil, silver, iron, and so on. Hard commodities can even get as esoteric as rubber. However, not all markets are created equal, so SmartCryptex offers the most liquid and widely traded markets.

Soft commodities

Soft commodities can be thought of as raw materials that are grown. This would include sugar, corn, lumber, wheat, coffee, cocoa, and so on. Soft commodities do have weather patterns to consider, as they can have a massive influence on the output.

For example, flooding in the Midwest part of the United States could have a detrimental effect on the corn supply, thereby driving price up due to supply not being able to keep up with demand. Soft commodity traders tend to keep an eye on weather patterns for whatever market they are trading.

Commodity stocks

Traders can decide to try to benefit from a commodity move via the stock market, however, this brings more operational risk. For example, you may find a company that is involved in mining gold, a commodity that you believe will continue to go higher.

This company then proceeds to have problems with the CFO, as they have over-reported potential ore being mined while understating losses. While this is not as common due to regulation, even though gold would continue to rise, your stock would lose money. There are a whole host of extra risks that come with concentrating your investment into a particular company.

Commodity ETFs

A lot less risky than a commodity stock would be a commodity ETF. An exchange-traded fund is a basket of stocks that have to do with a particular commodity. It can also include futures contracts, so when you get a mix of a handful of companies and the underlying asset itself, it can mitigate quite a bit of risk. That being said, you typically will have less volatility but also have less potential for gain as while some companies go higher, some may go lower at the same time, slowing down movement.

Learn what moves a commodity’s price

If you are going to trade a market, you need to know what can affect the price. The commodity markets are going to be no different than many other markets, but at the same time, there are some unique features. By understanding how these markets work, you increase the likelihood of being successful.

- Supply and demand: Supply and demand is the main driver of any market, but this is especially true with commodities. If there is not enough of a commodity to go around, traders will bid it up as it will become worth much more. The exact opposite is also true.

- Inflation: Inflation concerns can also influence commodities, as traders will try to buy “things” to preserve wealth. This is especially true with precious metals.

- Weather: Weather can have an effect on soft commodities such as corn and wheat, as flooding or drought can have a detrimental effect on production. It is also true that a “bumper crop” can flood the market with supply, driving down the price.

- Geopolitical concerns: Geopolitical concerns can also be a driver of commodities in special circumstances. As an example, the conflict between Russia and Ukraine puts one-third of the world’s wheat production at risk.

Create your commodity trading account

The first step you will need to make is to open up your commodity trading account. At SmartCryptex, we have simplified the process, with the initial process being to just confirm your email. As an added benefit to trading commodities at SmartCryptex, you can also trade currencies, indices, and crypto markets.

Discover how commodities trading works

To profit from commodity markets, you need to understand some of the basic functions of how these markets behave. Futures markets, spot markets, options, stocks, and ETFs are all possibilities. Understanding the strength and weaknesses of each trading vehicle is crucial.

Trading commodity futures

Trading commodity futures allows traders to enter an agreement through a regulated exchange. This works more like the stock market, as you will go through a central clearinghouse such as the Chicago Mercantile Exchange. It is the job of the CME to mix-and-match orders to keep an orderly market.

While trading futures is a great way to get exposure to commodities, the reality is that most futures contracts are quite expensive, as it takes much more margin to be involved. Furthermore, the standardized contracts can cause issues for retail traders, as it may be risky to trade an entire silver contract as an example, as it controls 5000 ounces.

Trading commodity spot prices

Trading commodity spot prices is done through the CFD, or contract for difference markets at SmartCryptex. The spot market is the simplest way to approach the commodity markets, as it is simply buying or selling something at an agreed-upon price. It works like the stock markets, in the sense that there is a spread in prices between what buyers and sellers are willing to transact. Sooner or later, someone agrees on a price, and the contract is traded.

The spot CFD markets also have the added benefit of being able to trade in smaller sizes. This means that they are the best option for new traders, as trading a small amount of a contract, such as little as one barrel of oil, can greatly mitigate the risk, while allowing the trader to trade in a real market.

As an example, let’s say you decide to buy gold. You buy it at $1951, and as the market moves in your favor, you decide to close the trade at $1955, making it a gain of $4 an ounce.

However, CFD trading allows leverage trading. At SmartCryptex, you can lever your gold trade as much as 500 times your deposit, meaning that you can trade $500 worth of gold for each $1 of available margin. This can mean massive profits with small deposits, although you can also lose large amounts if you are not careful with leverage. SmartCryptex recommends that you never use 100% of your total leverage at one time.

Trading commodity options

You can also trade options in commodity markets. This is when you are speculating on price movement by a specific time in a commodity. There are calls and puts, meaning that you are speculating on higher prices (calls), or lower prices (puts).

Options can be profitable, but it should be known that there are other issues such as time decay that the trader will have to be aware of. The closer that an option contract gets to expiration, the value will drift lower.

Options are leveraged products, meaning that you can benefit from putting up just a bit of capital to control a larger amount of a commodity. You can also sell an option, meaning that you can profit from the opposite of the specified direction.

Trading in stocks and ETFs

Trading in the stock market using either particular companies or ETFs is a possible way to benefit from the movement of commodities. The use of these assets can be profitable, but you must understand that there are inherent risks in using them.

The ETF, or Exchange Traded Fund, is an index of stocks and other assets that mimic a common theme.

The ETF, or Exchange Traded Fund, is an index of stocks and other assets that mimic a common theme. There are many different versions to choose from, such as SLV, which tracks both silver and silver-related companies. While this simplifies the idea of getting exposure to the price of silver, if one of the silver miners in the index fails, this could affect the probabilities of gains or losses.

One can also trade specific stocks, but this could lead to even more concentrated losses. Also, you could have a situation where a particular gold miner that you own loses a lot of value, even if gold rises. This can be related to regulations, permit issues, financial mismanagement, or a whole host of other company-specific issues.

Find a commodity opportunity

To find a commodity trading opportunity, you will have some type of trading strategy or methodology in mind. Traders will typically either scan the charts to see technical patterns or pay attention to fundamental news, such as whether in the case of soft commodities.

Regardless of how you decide to trade, make sure that you have a system in place so that you know when you are getting in, when you are admitting a trait has gone against you, and when you are taking profit in a successful move.

Open your first position

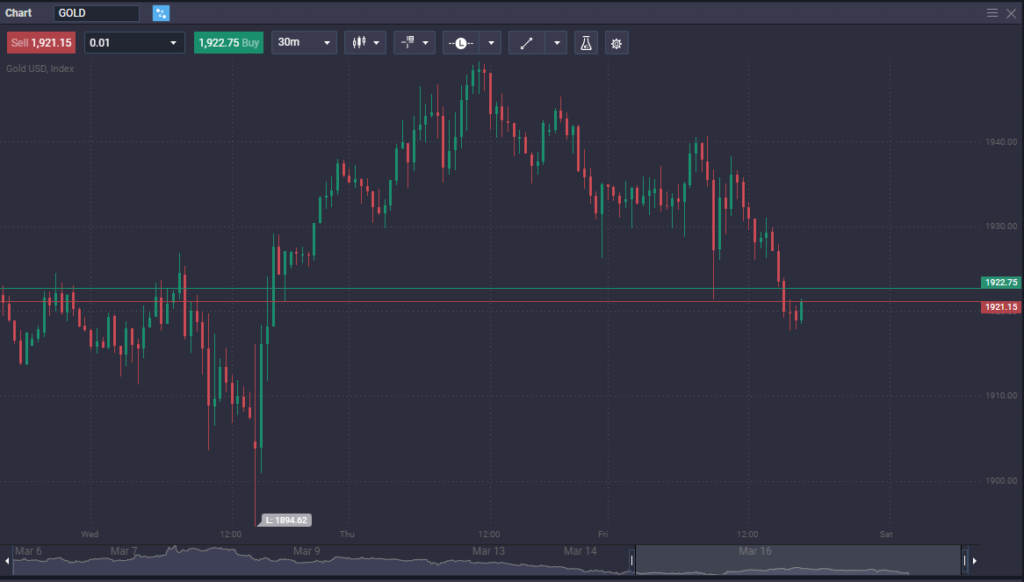

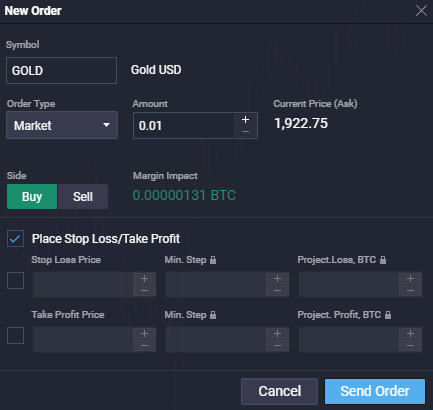

Now that you know what you want to trade and perhaps even the setup you are looking for, it is time to open up your first position. On the SmartCryptex platform, you can either buy or sell by simply clicking a couple of buttons.

When you do open up your first trade, make sure you have an idea as to where you are trying to take profit, but perhaps more importantly, where you need to place your stop-loss order. Your stop-loss order will protect you from massive and unnecessary losses and is easy to do using our order window.

Once the trade has been executed, you will monitor to see how the trade unfolds. This can be something that you do in real-time or something that you do over several hours, or even days, depending on the kind of timeframe you are looking at. If you are trading for a longer-term move, obviously you will monitor the trade much less frequently.

You will eventually close to trade, either via your stop loss being hit for a loss, or you will take profit either manually or with what is known as a limit order. This order tells SmartCryptex to exit if a certain price has been hit.

What Are Risk Management Strategies?

Risk management strategies include money management, stop-loss orders, and anything that will protect your account. The first job of any trader is to protect their trading capital. The market can move suddenly, and when it does you need to make sure you do not lose too much at any one given time.

Most traders will have a set amount that they are willing to risk on any particular trade when they buy and sell, respectively. A lot of people will use a percentage of something like 1% per trade. This is because traders can often have a string of losses, and by doing this, they can “stay alive” even though they are on the wrong side of the market.

If you trade with more risk, disaster is almost always the result. Compound interest works both ways, for gains and losses. If a trader loses 10% on a trade, the next one needs to make 11% to get back to the original amount. As you lose more, it becomes even direr.

Conclusion

Trading commodities is a great way to play pure supply and demand dynamics in the marketplace, as raw materials affect so much in the economy. Using CFD markets at SmartCryptex, traders have the advantage of not putting up huge amounts of trading capital like they would trading futures. By speculating on pure price action, a lot of the concerns that go with trading a commodity futures contract disappear.

While there are a handful of unique factors with commodity trading, the reality is that it is a much purer form of trading, without a lot of the unnecessary burden of going through financial statements, listening to earnings calls, or worrying about central bank bond purchases. If there is high demand for a specific raw material, prices go higher, and of course, the exact opposite is true.

The world-class platform that we use at SmartCryptex allows for traders to simply worry about where the market is going, and not worry about so many of the risks involved in other markets. Traders simply buy or sell and set orders while we do the rest.

Quite often, traders from other markets find the commodity trading works out quite well and are typically a lot less noisy than some of the other markets available.

Can anyone trade commodities?

Yes, all that it takes to trade these markets is access via a broker like SmartCryptex. The markets are some of the most popular markets in the world that fall under this category and allow for diversification.

How much money do you need to trade commodities?

It takes very little for traders to get involved in the commodity CFD markets. The futures markets can be very expensive, but at SmartCryptex, you can open an account for free. Simply deposit your BTC to begin trading. Commodities can be traded with as little size as 1 barrel of oil, or 0.10 oz of gold as an example.

Can you get rich trading commodities?

Yes, of course. Some of the world’s most successful traders come from the commodity world.

Is commodity trading good for beginners?

Yes, but only with CFD markets. The futures markets can be an expensive place to learn, but the ability to trade minute amounts makes the markets available to all skill levels.

How do you profit from commodities?

You profit by trading in the correct direction of price movement, just as you would with any other market. The commodity markets tend to be especially sensitive to supply and demand, especially in comparison to other markets such as stocks and crypto.